The PRGF was introduced by the WRA to ensure that a gratuity is paid under the following circumstances:

(a) to a worker when he retires;

(b) to a worker’s legal heirs on his demise;

(c) to a self-employed who retires and who has contributed to the PRGF; or

(d) to the legal heirs of a self-employed who has passed away and who contributed to the PRGF.

On 19 February 2020, the Minister of Labour, Human Resource Development and Training (Minister) issued the Workers’ Rights (Portable Retirement Gratuity Fund) Regulations 2020 (PRGF Regulations).

The PRGF Regulations confirm (i) the procedure to be followed in order to lodge claims under the PRGF (ii) an employer’s obligation to contribute a monthly amount in respect of every worker and (iii) that the monthly payment is to be made electronically ‘through such computer system as the Director-General [of the Mauritius Revenue Authority] or the administrator [of the PRGF], as the case may be, may approve.’

Of importance, the PRGF Regulations confirm that a ‘worker’ for the purposes of the PRGF excludes a person whose monthly basic wage or salary exceeds MUR 200,000 [± USD 5400] but designates the persons below:

- a worker who is above 50 years and who is not covered by a private pension scheme; and

- an atypical worker.

The WRA has left undefined the term ‘atypical worker’ which however, has been defined as a person who is over 18 years and who is not employed by his employer under a standard agreement. Its comprehensive definition, which also captures those persons who are expressly excluded within its scope, is set out in the Workers’ Rights (Atypical Work) Regulations 2019 which were issued by the Minister on 11 October 2019.

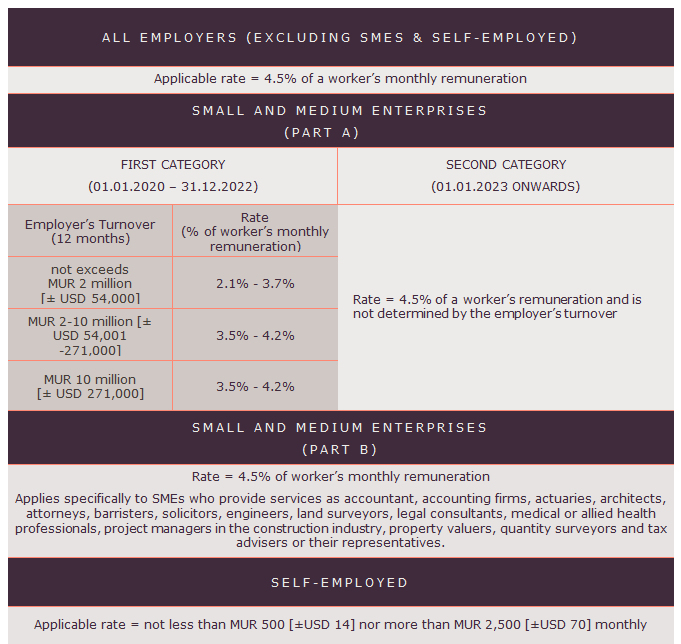

Insofar as the applicable contributions for the PRGF are concerned, the PRGF Regulations set down the general principle that an employer must pay 4.5% of a worker’s monthly remuneration into the PRGF.

The PRGF Regulations go further as they prescribe the applicable rates in respect of Small and Medium Enterprises (SMEs) in respect of which the PRGF Regulations identify 2 categories of time periods. The first category is for the period 01 January 2020 to 31 December 2022. The second category is for the period 01 January 2023 onwards. As to the self-employed, the PRGF Regulations have a different approach. Instead of prescribing a percentage for the self-employed the PRGF Regulations prescribe a monetary range as outlined in the table below.

A summary of the applicable rates is outlined in table form below: