The Cayman Islands’ International Tax Co-operation (Economic Substance) Law, 2018 (ES Law) and The International Tax Co-Operation (Economic Substance) (Prescribed Dates) Regulations, 2018 (ES Regulations) came into force on 1 January 2019. The regime became applicable immediately to new relevant entities incorporated or registered after that date. For existing relevant entities, there was a six-month transition period which ended on 1 July 2019.

The ES Law is supplemented by the Cayman Islands guidance for economic substance for geographically mobile activities (ES Guidance Notes), version 2.0 of which was published on 30 April 2019.

A “relevant entity” is only in scope of the Cayman Islands economic substance requirements if and to the extent that it conducts any “relevant activity”. Cayman Islands exempted companies, limited liability companies (LLCs), limited liability partnerships (LLPs) and foreign companies registered in the Cayman Islands will be considered to be “relevant entities” unless they meet the definition of “investment fund” or “domestic company” under the ES Law, or are “tax resident outside of the Cayman Islands”, as contemplated under the ES Law and within ES Guidance Notes.

Relevant activities include banking business, distribution and service centre business, financing and leasing business, fund management business, headquarters business, holding company business, insurance company business, intellectual property business and shipping business.

Whilst many clients have already undertaken the exercise of classifying their Cayman Islands entities for purposes of the ES Law, we continue to get enquiries from persons with existing entities seeking guidance on the regime and its application to their circumstances. We strongly recommend that anyone who has not yet addressed the implications of the ES Law on their Cayman entities do so as a matter of urgency. Appleby would be pleased to assist in this endeavor. Please contact a member of our Regulatory Team or your usual Appleby contact.

Additionally, we encourage those who have already undertaken the classification exercise to remain mindful of certain developments that are still anticipated to occur before year end, as discussed below.

ES Regulations and Guidance Notes

In an industry update circulated on 26 July 2019, the Department of International Tax Cooperation (DITC) advised, among other things, that version 3.0 of the ES Guidance Notes was being drafted and that the next iteration of the notes would include sector-specific guidance for each relevant activity, as well as guidance for investment funds. Working groups from industry sector groups met with the DITC at the end of August 2019. The consultation period has now concluded, and version 3.0 of the ES Guidance Notes is anticipated to be released towards the end of October or at the beginning of November 2019.

On 10 September 2019, the Cayman Islands government (through Cabinet) amended the ES Regulations to include provisions relating to “MNE Groups”. “MNE Group” refers to any group that includes two or more enterprises for which the tax residence is in different jurisdictions or includes an enterprise that is resident for tax purposes in one jurisdiction and is subject to tax with respect to the business carried out through a permanent establishment in another jurisdiction”. MNE Groups are specifically excluded from the definition of “domestic company” under the ES Law in order to ensure that a company which is carrying on business both within the Cayman Islands and also business exterior to the Cayman Islands cannot avail itself of the exemption from the definition of “relevant entity” for domestic companies. Corresponding changes to the ES Guidance Notes version 2.0 were published on 17 September 2019.

ES Notification and Reporting

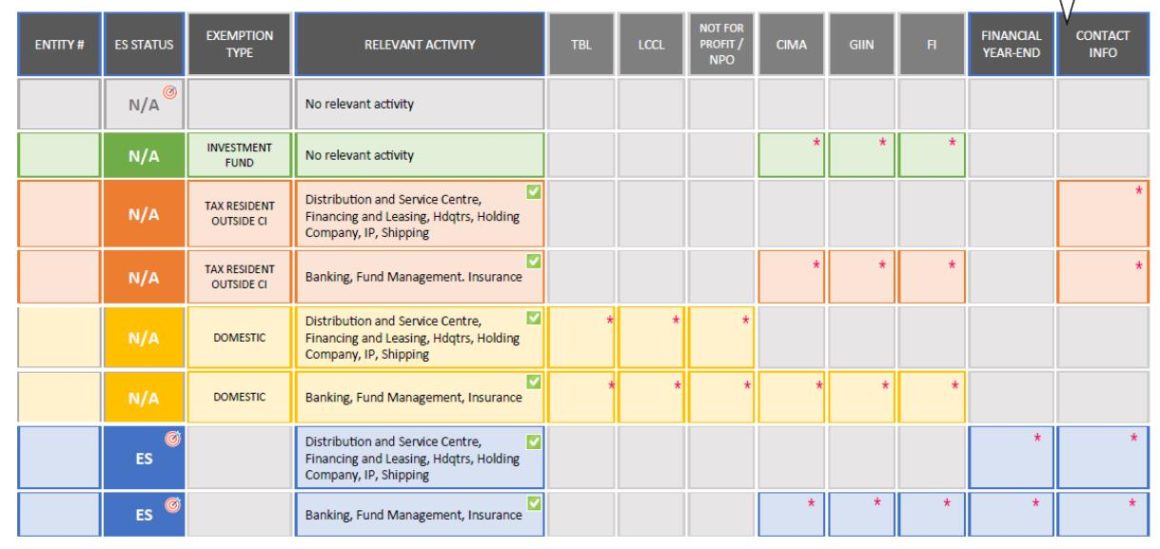

Exempted companies, foreign companies, LLCs and LLPs will each be required to file a notification form under the ES Law (ES Notification). The ES Notification will be filed via the General Registry system of the Registrar of Companies of the Cayman Islands. The notification form will be separate from the General Registry’s annual return for companies but, in terms of timing, the completion and filing of the ES Notification will be a prerequisite to filing the annual return. The below reference document published by the DITC shows exactly what each entity will have to disclose in the ES Notification form:

Entities claiming to be exempt by virtue of tax residence elsewhere will be required to support their claim with additional information that follows the OECD’s Nominal Tax Jurisdiction schema, which is still in development.

Timing

- October 15 – ES Notification form released

- Late October/early November – sector specific guidance notes

- July 2020 – ES Portal should be live

- December 2020 – first ES return due

Economic Substance Online Tool

Appleby has an online Economic Substance Entity Classification Questionnaire which offers guidance through the economic substance regime of the Cayman Islands (as well as the regimes of Bermuda, the BVI, Guernsey, the Isle of Man and Jersey). It was developed by our legal and regulatory experts and is available online free of charge. If an entity is in scope of a jurisdiction’s economic substance requirements, the Questionnaire will provide a summary of steps required to meet those requirements.