Guernsey has seen a growth of investment management services including the subsidiaries of some of the largest multinational houses, as well as independent boutiques – together delivering a full range of asset management and stockbroking solutions to both private and corporate clients.

According to the latest figures from the Guernsey Financial Services Commission (GFSC) the funds business in Guernsey has total assets, under management and administration, amounting to £288.8 billion.

Regulation of Funds in Guernsey

Funds domiciled in Guernsey are regulated by the GFSC and are subject to the provisions of The Protection of Investors (Bailiwick of Guernsey) Law, 2020 (POI Law) and the Financial Services Business (Enforcement Powers) (Bailiwick of Guernsey) Law, 2020.

WHAT IS A GUERNSEY FUND?

The POI Law considers a collective investment scheme (fund) to be constituted by any arrangement relating to property of any description (including money) characterised by the following criteria:

- the pooling of investor’s contributions;

- the purpose or effect of which is to enable investors to participate in, or receive profits or income arising from, the acquisition, holding, management or disposal of the property, or sums paid out of such profits or income;

- third party management of the property; and

- a spread of risk.

REGISTERED, AUTHORISED AND REGULATED FUNDS

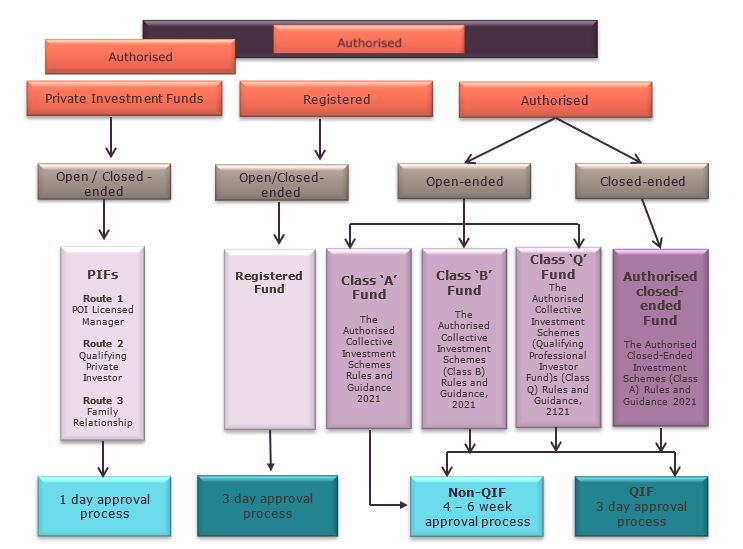

In essence there are three types of fund categories in Guernsey.

- Authorised funds;

- Registered funds; and

- Private Investment funds.

The POI Law establishes that a fund may be declared by the GFSC to be an authorised or registered fund of a specified class. Guernsey’s Private Investment Fund (PIF) regime is a quick to market, light touch regulatory framework for funds targeting a limited number of investors.

AUTHORISED FUNDS

Authorised funds are declared as such by the GFSC following a review of their suitability. The review or approval process of authorised funds normally follows the three-stage process below:

- Outline consent: this involves the provision of detailed information on the promoter and general information in relation to the proposed fund; followed by

- Interim consent: once the promoter has obtained outline consent, draft documentation on the fund structure itself is submitted to the GFSC for review. If successful, this application will result in notification that the GFSC will be inclined to grant final approval upon receipt of final certified documentation; and

- Final consent: final signed/certified documentation is lodged, and the GFSC’s consent is issued within 48 hours.

Classes of authorised fund:

- Funds authorised under The Authorised Collective Investment Schemes Rules and Guidance, 2021;

- Funds authorised under The Authorised Collective Investment Schemes (Class B) Rules and Guidance, 2021;

- Funds authorised under The Collective Investment Schemes (Qualifying Professional Investor Funds) (Class Q) Rules and Guidance, 2021; and

- Funds authorised under The Authorised Closed- Ended Investment Schemes Rules and Guidance, 2021

REGISTERED FUNDS

Registered funds on the other hand are declared as such following a representation to the GFSC by a POI Law licensed Guernsey entity (an administrator) as to their suitability. In the case of a registered fund the administrator assumes the ongoing responsibility of monitoring the fund.

Types of registered fund

- RCIS Fund: funds registered under The Registered Collective Investment Schemes Rules and Guidance, 2021; and

- Manager Led Product: funds registered as a Manager Led Product.

Private Investment Funds

PIFs are regulated by the GFSC. The PIF regime was first established in 2016 and two new classes of PIF were added in 2021.

The POI Law grants the GFSC the ability to develop different classes of funds and determine the rules applicable to such classes. Private investment funds are subject to The Private Investment Fund Rules and Guidance, 2021. PIFs can be open-ended or closed-ended.

There are three routes to PIF status:

- Route 1 –POI Licensed Manager: suitable for funds where the fund manager has an existing close relationship with its investors;

- Route 2 – Qualifying Private Investor: suitable for funds marketed only to a limited number of qualifying private investors (professional investors, experienced investors and knowledgeable employees); and

- Route 3 – Family Relationship: open only to investors who share a family relationship or are an eligible employee of the relevant family.

OPEN-ENDED AND CLOSED-ENDED FUNDS

As mention above, a fund may be of a specified class. The GFSC therefore has the ability to create different classes of authorised or regulated funds, and to stipulate the rules specific to each such class. The rules governing the different classes of registered and authorised funds state whether the funds are open ended or closed ended.

In an open-ended fund investors are entitled to have their units redeemed or repurchased by the fund, or to sell their units on an investment exchange.

In a closed-ended fund investors are not entitled to have their units redeemed or repurchased by the fund, or to sell their units on an investment exchange.

THE GUERNSEY GREEN FUND

The GFSC, in exercise of powers conferred to it by the POI Law, has enacted The Guernsey Green Fund Rules and Guidance, 2021 (Green Fund Rules) which govern Guernsey Green Funds.

The GFSC’s rationale for developing the Green Fund Rules was to develop a transparent product through which investments in green initiatives can be made, and in so doing assure investors that their investments have a positive environmental impact on the planet.

Guernsey Green Funds can either be registered or authorised funds which meet the green criteria set out in the Green Fund Rules.

TAXATION OF GUERNSEY FUNDS

The rate of corporation tax for companies registered in Guernsey is zero per cent.

Authorised or registered funds (whether constituted as a company, a unit trust or a limited partnership) and their wholly-owned subsidiaries may apply to the Director of Income Tax for exemption from income tax in Guernsey under the Income Tax (Exempt Bodies) (Guernsey) Ordinance, 1989, as amended, and, subject to meeting certain criteria, the exemption, if granted, would apply to all income save for any income arising in Guernsey (other than Guernsey bank interest). In the absence of such exemption, companies that are authorised or registered funds are subject to income tax at the company standard rate of 0%.

The fee for exempt status is £1,200 per annum. There are no Guernsey withholding taxes on dividends other than those paid to Guernsey resident shareholders, and there is no Guernsey capital gains tax.

Economic Substance

Guernsey has in place economic substance legislation to address the concerns of the EU Code of Conduct Group for Business Taxation that certain Guernsey tax resident companies may be used to artificially attract profits that are not commensurate with economic activities and substantial economic presence in Guernsey. The Income Tax (Substance Requirements) (Implementation) Regulations, 2018 (Regulations), require Guernsey tax resident companies carrying on specified activities in respect of accounting periods beginning after 31 December 2018 (and every following accounting period) to demonstrate that they have substantive presence in Guernsey.

The relevant activities are: banking, insurance, fund management, financing and leasing, shipping, intellectual property, headquartering, distribution and service centres and holding companies (although holding companies are treated separately under the Regulations). The substance requirements vary for each key activity to reflect the different needs of the companies involved.

Essentially, such companies will have to demonstrate that they each have substance in Guernsey by (i) being directed and managed in Guernsey, (ii) having adequate people, premises and expenditure in Guernsey and (iii) conducting core income generating activities in Guernsey (CIGA).

Tax resident protected cell companies and incorporated cell companies are subject to the substance requirements if they have income from a relevant activity, but how the substance requirements are applied varies as follows:

- a PCC is a single legal entity and, therefore, will be required to satisfy the substance requirements at a whole entity level including the activities and resources of all its protected cells (each cell will need to demonstrate that it conducts CIGA in Guernsey ). Each cell is not itself a body corporate and so its activities and resources form part of the overall substance information to be reported by the PCC and it is not required to report any substance requirements on its own account; and

- an ICC is a legal entity and its incorporated cells are also separate legal entities. Given this, the ICC will only have to satisfy the substance requirements in relation to any activities it conducts itself and not for any Relevant Activities conducted by its ICs or taking into account any resources of its ICs. Each IC will have to satisfy the substance requirements in relation to its own activities and referring to its own resources without taking into account resources of any other ICs or the ICC itself.

Out of scope entities include foundations (by virtue of the Income Tax (Substance Requirements) (Implementation) (Amendment) Regulations, 2018) and trusts, although trustees that are themselves companies may be caught. A failure to comply could result in substantial penalties and, ultimately, strike-off.

Economic substance requirements that apply to companies now extend to partnerships. The reason is to fully meet commitments the States of Guernsey gave to the EU Code of Conduct Group (Business Taxation) in 2018.

The term “partnerships” includes:

- General partnerships formed in Guernsey;

- Limited partnerships (both with and without legal personality) formed under the Limited Partnerships (Guernsey) Law, 1995;

- Limited liability partnerships formed under the Limited Liability Partnerships (Guernsey) Law, 2013; and

- Foreign partnerships (including limited partnerships and limited liability partnerships) formed outside of Guernsey which have their place of effective management in Guernsey and carry on business activity in Guernsey.

These requirements apply to accounting periods which commenced on or after 1 January 2022 for partnerships existing as at 30 June 2021. Any partnerships formed on or after 1 July 2021 were deemed to be in scope for accounting periods commencing on or after 1 July 2021.

A complete discussion of Guernsey’s economic substance requirements is beyond the scope of this overview, please contact us if you wish to consider this further.

One sector that is in-scope of the new regime, and therefore subject to the new requirements is the fund management industry in Guernsey. Guernsey tax-resident fund managers who are licensed to carry on controlled investment business in relation to collective investment schemes under the POI Law are in scope of the law where they have income in relation to their fund management activities. Fund vehicles themselves are outside the scope of the law. Services such as fund administration, advisory services and custody services are also outside of the scope.

Guernsey as a jurisdiction

Guernsey has more than 50 years’ business experience in investment funds, and is host to a variety of investment funds businesses including advisors, stock brokers, fund managers, custodians and administrators. Guernsey is a world-leading location in which to conduct international funds business – offering vast experience in dealing with funds of hedge funds, private equity and property, together with more unusual investments such as fine art and fine wine. Guernsey has expertise in a wide range of investment vehicles including unit trusts, PCCs, ICCs and limited partnerships.

As a British Crown Dependency, Guernsey has a stable and reliable legal system. With a long history of political stability, a highly respected regulatory framework and its accessibility via an established infrastructure make it a desirable international offshore destination for businesses. Guernsey’s agile and pro-business government, low tax regime and compliance with international standards of regulation and transparency provide a secure and competitive choice for investment funds.

This Overview was last updated in April 2025. It is routinely reviewed by Appleby and updated when changes to the law require it. This Overview is for general guidance only and does not constitute definitive advice.

For more specific advice on funds in Guernsey please contact Tristan Ozanne or Dylan Latimer.