INTERNATIONAL CANNABIS POLICY

The cultivation and production of cannabis for recreational purposes is now lawful in a number of countries including Canada, South Africa, plus 17 states, two territories, and the District of Columbia in the United States and the Australian Capital Territory in Australia. In the last few weeks alone, three US states (New York, Virginia and New Mexico) have legalised cannabis for recreational purposes, all via the legislature and not via public ballots, with the intention to introduce commercial markets in the coming years. Meanwhile, the global medicinal cannabis market size was valued at GBP5.64(USD7.8bn) in 2020, and there are now 20 countries in Europe that have approved the use of medical cannabis. The IMARC Group (a leading management strategy group) estimate medicinal cannabis market growth by as much as 15.3% from 2021 to 2026.

LEGAL STATUS IN JERSEY

Under Jersey law, cannabinol derivatives and cannabinol, except where contained in cannabis or cannabis resin are both categorised as Class A controlled drugs under Part 1 of Schedule 2 the Misuse of Drugs (Jersey) Law 1978 (MODL), and both cannabis and cannabis resin are categorised as Class B controlled drugs under Part 2 of Schedule 2 of MODL. All these substances are further controlled under the provisions of the Misuse of Drugs (Designation) (Jersey) Order 1989 (1989 Order) and as Schedule 1 substances under the provisions of the Misuse of Drugs (General Provisions) (Jersey) Order 2009 (2009 Order).

Substances placed under the control of the 1989 Order, the highest level of control, are substances for which there is generally accepted to be no therapeutic use and for which it is in the public interest that any use should only be for research or other special purposes. Any such limited activity in relation to substances controlled by the 1989 Order must be under the authority of a licence issued by the Minister for Health and Social Services.

Any activity in relation to the Schedule 1 substances under the provisions of 2009 Order must again only be under the authority of a licence issued by the Health Minister, but such licenses are not necessarily restricted to research or other special purposes unless the substance is also controlled under the 1989 Order.

Limited exemptions from these levels of control were introduced following amendments to the 1989 Order under the Misuse of Drugs (Miscellaneous Amendments) (No. 7) (Jersey) Order 2018, in order to enable doctors to prescribe cannabis-based products for medicinal use on 1st January 2019. Since then interest in the use of cannabis-based products for medicinal use has increased with emerging evidence of therapeutic benefits in some conditions.

The Misuse of Drugs Advisory Council (MDAC) was established in accordance with Article 2 of MODL and has a duty to advise the Minister on measures, which in its opinion, should be taken to prevent the misuse of drugs and/or to deal with the social problems connected with drug abuse.

Following advice from the MDAC, that keeping cannabis and related substances under the control of the 1989 Order was no longer consistent with the increasing evidence for use for medical purposes, further amendments were made to the 1989 Order under the Misuse of Drugs (Miscellaneous Amendments) (No. 8) (Jersey) Order 2019 (2019 Order). The MDAC further concluded that these substances should remain Schedule 1 substances under the provisions of 2009 Order such that any activity in relation to these substances must be authorised by licence issued by the Health Minister.

CANNABINOIDS

Cannabis and cannabis resin are plant products containing a wide range of chemicals generally termed cannabinoids. The most significant of these in terms of psychoactive effect is Δ9–tetrahydrocannabinol (THC). Recently there has been increased popular interest in some of the other major cannabinoids, particularly cannabidiol (CBD). A variety of health claims have been ascribed to the consumption of this compound, which is generally accepted not to have any significant psychoactive effects. In November 2020, the European Court of Justice published a judgement stating that CBD extracted from the cannabis plant should not be considered a drug under the 1961 United Nations Single Convention on Narcotic Drugs (UN Narcotic Convention).

There are now numerous CBD products being marketed and sold as dietary supplements. These products are designed for the administration of CBD but almost always contain trace amounts of THC. It is virtually impossible to remove all trace amounts of THC which makes many of these products subject to control under misuse of drugs legislation unless they qualify as an exempt product as defined under 2009 Order.

The MDAC concluded that it would be reasonable and proportionate to permit small amounts of THC and other cannabinoids to be present in CBD products sold as food supplements. The 2019 Order amended the 2009 Order to permit the preparation of cannabidiol which (i) has its ingredients clearly labelled, (ii) contains not more than 3% cannabinol and/or cannabinol derivatives relative to its cannabidiol content, by weight, (iii) does not contain any other controlled drug, (iv) does not contain any plant material visible to the naked eye, and (v) has the matter of the combined weight attested by an official certificate of analysis, or by the Official Analyst appointed under Article 2 of the Food Safety (Jersey) Law 1966.

Any CBD preparation meeting the above requirements should be exempted from controls on importation, possession, supply, administration. However, exportation should still be unlawful except when in accordance with a licence issued under the provisions of 2009 Order.

INVESTMENT BY JERSEY VEHICLES INTO CANNABIS AND OTHER CANNABIS-RELATED ASSETS OVERSEAS AND THE PROVISION OF RELATED FINANCIAL SERVICES

It has been recognised that the Proceeds of Crime (Jersey) Law 1999 (POCL) has the potential to create dual criminality for persons who receive income in Jersey from activities which occur legally abroad but which are unlawful in Jersey.

Jersey investors receiving income or dividends from investments in overseas medicinal cannabis companies will also need to ensure that they do not fall foul of POCL.

There are a number of offences under POCL, including:

- concealing, disguising, removal, converting or transferring criminal property;

- entering into or becoming concerned in an arrangement to launder; and

- using, acquiring, possessing or controlling criminal property.

The meaning of “criminal property” is crucial to determining whether an offence has been committed. Property will be considered “criminal” if it includes “any property derived from or obtained, directly or indirectly, through criminal conduct” and “the alleged offender knows or suspects that the property is derived from or obtained, directly or indirectly, through criminal conduct”. Property will also be considered “criminal” if it includes “any property that is used in, or intended to be used in, criminal conduct” and “the alleged offender knows or suspects that the property is used in, or is intended to be used in, criminal conduct” (Article 29(1) of POCL). Conduct will be deemed “criminal” if it “occurs or has occurred outside Jersey, [and] would have constituted such an offence if occurring in Jersey” (Article 1(1) of POCL).

As such, a Jersey entity would be breaching POCL if its proceeds were the result of conduct that is illegal in the jurisdiction the conduct took place or would be illegal in Jersey if such conduct took place in Jersey. Consequently, difficulties can arise when Jersey investors or financial services businesses are seeking to invest in or provide related services to a company that operates outside of the Bailiwick of Jersey or an investor in such a company. Such investors or financial services businesses will need to ensure that they are legally permitted to do so. To illustrate, a Jersey based investor wanting to buy shares in a German company that grows and cultivates cannabis for medicinal purposes in Germany (which may sit outside what is permitted under Jersey law) will need to make sure that it will not face criminal liability for (a) investing in the German company and (b) receiving dividends or income from its investment in the company. The same would also be true if the German company wanted to list on AIM or the London Stock Exchange (LSE).

The cannabis company may, under the dual criminality test in POCL, for Jersey purposes be undertaking criminal conduct as it does not have a license in Jersey to produce cannabis and so, arguably, the proceed form an investment may be the proceeds of crime. It is unclear what threshold the authorities in Jersey would apply as being the point beyond which they would seek to prosecute in Jersey for money laundering offences where the underlying criminal conduct is lawful cannabis production and distribution outside the Bailiwick.

This is reinforced by the fact that there is already a legal structure for the agriculture, production, research and development of medicinal cannabis products in Jersey. As discussed further below, the Government of Jersey under the authority of the UK Home Office has already granted licences to cultivate plants of the genus Cannabis. The Government of Jersey has also recognised (as discussed above) that derivatives of cannabis can have medical benefits, which further supports this notion.

When it comes to the recreational use of cannabis, however, the Government of Jersey has not taken any steps in the direction of legalisation and so the risks of investing in a foreign company producing recreational cannabis would be considerably more problematic – until recently.

Under the amendments proposed by the Proceeds of Crime (Amendment of Law) (No. 2) (Jersey) Regulations 202- and the accompanying order, the Proceeds of Crime (Cannabis Exemption – List of Jurisdictions) (Jersey) Order 202- (Cannabis Exemption Order), if the cannabis related activity is lawful where and when it takes place (and it occurs in a listed jurisdiction) then the proceeds are lawful even if the activity would be illegal in Jersey.

Pursuant to the amendment, the definition of “criminal conduct” under Article 1(1) (Interpretation) of POCL, as amended, will read as follows:

“criminal conduct” means conduct, whether occurring before or after Article 3 comes into force, that –

(a) constitutes an offence specified in Schedule 1; or

(b) if it occurs or has occurred outside Jersey, would have constituted such an offence if occurring in Jersey, but does not include the production, supply, use, export or import of cannabis or any of its derivatives that –

(i) is lawful where and when it occurs, and

(ii) occurs in a jurisdiction outside Jersey that the Minister for External Relations and Financial Services may by Order specify;

For these purposes, “cannabis” means any plant of the genus Cannabis and any part of such plant and each of the terms “production”, “supply”, and “supplying” will take the same meaning as is given to each such expression by MODL.

Under the Cannabis Exemption Order, the List of Jurisdictions include 22 EU member states, Australia, Guernsey, the Isle of Man, New Zealand, Norway, South Africa, Switzerland, Canada and the United States of America.

The proposed amendments also provide retrospective effect where proceeds are generated from conduct occurring outside of Jersey which was lawful both where and when it occurred – even if the conduct took place before the draft Regulations come into force.

The proposed amendments remove the test of dual criminality and will allow Jersey companies/funds and investors in Jersey companies to invest in cannabis-related businesses (CRBs) operating in the List of Jurisdictions under the Cannabis Exemption Order without fear of prosecution. It will also allow banks and other service providers in Jersey to provide services without risk of breaching anti-money laundering legislation.

These changes to the law in Jersey will provide a competitive advantage for Jersey entities looking to invest in an industry that is about the provision of medicine, innovative cutting-edge science, high-value agriculture, the creation of intellectual property and global regulation, both at home and further afield.

KEY CONSIDERATIONS FOR PRIVATE INVESTMENT

If a Jersey investor is considering making a private investment into foreign CRBs, they will need to ensure that they have robust contractual protections in place. Such protection may take the form of warranties, covenants or undertakings to seek comfort that the company they are investing in has fully complied with local laws and to ensure ongoing compliance. It is unlikely that any further protection in the form of indemnities would be provided and, in any case, such protection would not be effective against the risk of criminal liability. Investors and service providers will need to ensure the continued compliance by the CRB with the conditions set out in the Cannabis Exemption Order and have processes in place to address any failure to continue to satisfy such conditions.

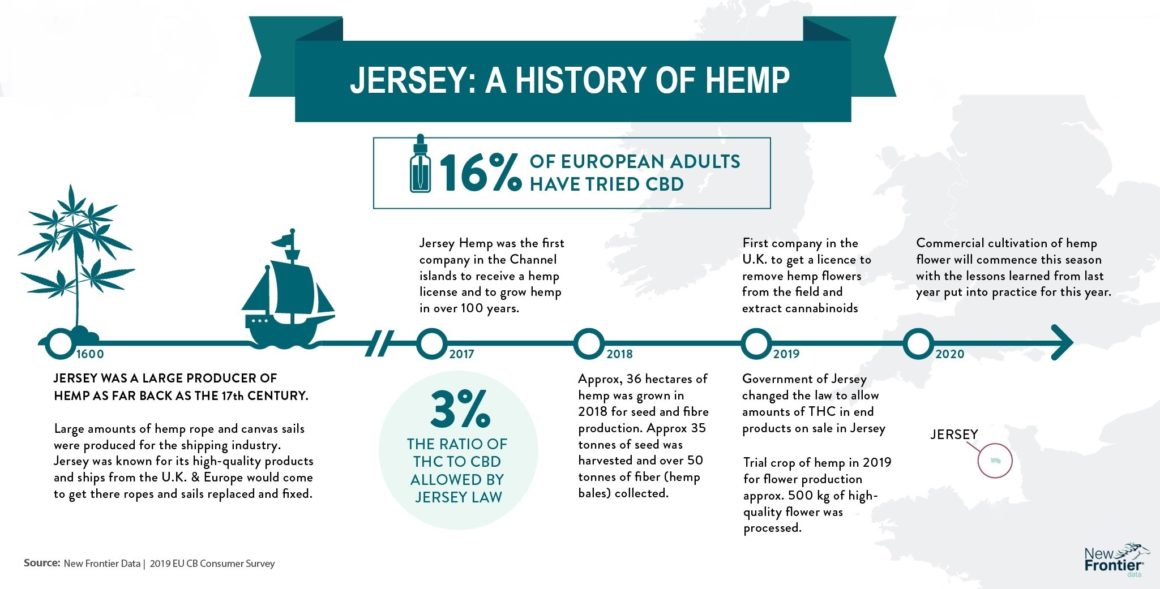

JERSEY ISSUES FIRST LICENCES FOR CULTIVATION OF CANNABIS PLANT

At the end of 2020, the Government of Jersey had issued the first licences for commercial cultivation of medicinal cannabis in the Channel Islands. Senator Lyndon Farnham stated that the issuing of a licence follows a period of extensive screening and scrutiny, and when a licence is issued there is a condition that an environmental impact study is carried out. The licence fee structure is set out under the Misuse of Drugs (Licence Fees) (Jersey) Order 2020 (2020 Order).

The Government of Jersey has said the issuing of these licences puts the Island at the forefront of the emerging European medicinal cannabis market. Jersey has a number of competitive advantages which make it well placed to become a hub for the growing global cannabis industry, bolstering its cannabis investment framework.

European demand for medicinal cannabis is seeing annual patient growth rates of 60% in Germany and Italy, Europe’s largest legal markets. The existing agriculture industry of Jersey, proximity to key European markets and climate of over 2,400 hours of sunshine a year, means Jersey is well placed to take advantage of the imminent growth.

TAXATION OF PROFITS

The Finance (2021 Budget) (Jersey) Law 2021 which came into force on 1 January 2021 inserted a new Article 143AA ‘Power to make Regulations relating to companies in the cannabis industry’ to provide for the taxation of the profits of companies whose business involves or relates to cannabis or its derivatives. Senator Farnham recently confirmed that companies growing medicinal cannabis in Jersey will pay 20% tax on profits.

LISTING ON THE LONDON STOCK EXCHANGE

On 18 September 2020, the UK’s Financial Conduct Authority (FCA) updated its guidelines regarding CRBs looking to float on the LSE. The FCA announced that overseas and UK-based medicinal cannabis and CBD companies are eligible to float on the LSE as long as they abide by the UK Proceeds of Crime Act 2002 (POCA) and hold the appropriate UK Home Office licences.

Following the announcement, the LSE saw three listings of CRBs in 2021: MGC Pharmaceuticals Limited (LSE:MXC), Kanabo Group (LSE:KNB), and Cellular Goods PLC (LSE:CBX), and a number of other medicinal CRBs are also expected to float on the LSE in the coming months.

It is important to note that the FCA will not permit recreational cannabis companies to be admitted to the Official List as it considers that proceeds from such companies, even when they are located in jurisdictions that have legalised it, are proceeds of crime under POCA.

The first company in Jersey with a full THC cultivation license, medical cannabis cultivator Northern Leaf, is set to commence commercial production this year with a 75,000 square-feet operational facility already built and the capacity to increase its greenhouse cultivation area to over 600,000 square -feet over two sites. Earlier this year, the Jersey company raised USD19.21m in an offering that was oversubscribed, adding a number of global institutional investors alongside numerous family offices and ultra-high-net-worth individuals, ahead of its planned IPO on the LSE later in the year.

CONCLUSION

With the global industry likely to grow, potentially from USD20bn to over USD100bn of annual revenues in the next three to four years, a favourable regulatory environment in Jersey could offer significant advantage to companies wishing to engage in the cultivation, processing, and extraction of pharmaceutical precursors from cannabis as well as investment in and the provision of services to the wider global cannabis market. The potential for Jersey to become a centre of excellence in production, research, genetics and intellectual property in the sector is evident.