What are Private Trust Companies?

A private trust company (PTC) is a trust structure used by high net worth individuals wishing to establish and manage their own trust company, usually with the assistance of family members and trusted advisers.

A PTC is a privately owned company incorporated specifically to act as trustee of one or more family trusts. Like any other company, a PTC is run by its board of directors, who in the case of a PTC make the trustee decisions. Whilst run by the board of directors, PTCs (and the underlying trust for which they act as trustee) are usually administered by a professional trustee who is experienced at carrying out trust and corporate administration.

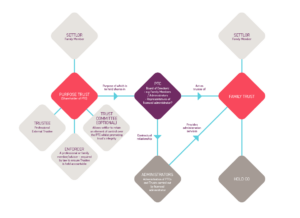

What does a typical PTC Structure look like?

The following is a typical PTC structure. PTC structures are very flexible and can be modified in a variety of ways to accommodate the particular needs of a client.

Whilst the client could own the shares in the PTC directly it would probably be undesirable for them to have any direct link with the PTC’s ownership, whether for tax, disclosure or for a variety of other reasons. Therefore, other vehicles such as a purpose trust or a foundation are considered more appropriate, the advantage being that the shares in the PTC are not directly attached to the client. The above structure refers to a “purpose trust” holding the shares in the company which will act as trustee of the family trust(s). A purpose trust is a particular type of trust which, unlike a conventional trust, can be formed to hold assets for a purpose without conferring a benefit on any person. Here the purpose would be to hold the shares in the PTC. Please see our overviews “Trusts in Guernsey” and “Foundations in Guernsey” for details on foundations, as an alternative to purpose trusts, for holding the shares in a PTC.

How to Establish a Private Trust Company (PTC)

The incorporation of a Guernsey PTC is the same as for any other Guernsey company with an application being made to the Guernsey Registry by an authorised corporate service provider and incorporation taking as little as two hours.

The PTC will be run by its board of directors and therefore careful thought needs to be given to the choice of directors to ensure that the PTC and ultimately the underlying trusts are run properly whilst avoiding potential pitfalls regarding management and control.

A PTC will only need to be licensed by the Guernsey regulator if it receives income, a fee or other monetary consideration. Whilst most PTCs do not charge for acting as trustee, they may in practice receive income to meet various expenses such as director/administrator fees etc. and in such cases an application can be made to the local regulator for an exemption to regulation.

The PTC and the trusts for which it acts as trustee will often be administered by a professional administrator (pursuant to an administration agreement) as the PTC and family trusts will need to be run properly with the assistance of a body who knows how to administer trusts/companies in accordance with the local laws.

The name of the PTC should not include the words “trust company” unless the regulator approves this.

Economic Substance

Guernsey has in place economic substance legislation to address the concerns of the EU Code of Conduct Group for Business Taxation that certain Guernsey tax resident companies may be used to artificially attract profits that are not commensurate with economic activities and substantial economic presence in Guernsey. The Income Tax (Substance Requirements) (Implementation) Regulations, 2018 (Regulations), require Guernsey tax resident companies carrying on specified activities in respect of accounting periods beginning after 31 December 2018 (and every following accounting period) to demonstrate that they have substantive presence in Guernsey.

The relevant activities are: banking, insurance, fund management, financing and leasing, shipping, intellectual property, headquartering, distribution and service centres and holding companies (although holding companies are treated separately under the Regulations). The substance requirements vary for each key activity to reflect the different needs of the companies involved.

Essentially, such companies will have to demonstrate that they each have substance in Guernsey by:

- being directed and managed in Guernsey,

- having adequate people, premises and expenditure in Guernsey and

- conducting core income generating activities in Guernsey.

Economic substance requirements that applied to companies now extend to partnerships. The reason is to fully meet commitments the States of Guernsey gave to the EU Code of Conduct Group (Business Taxation) in 2018. However, foundations and trusts are still out of scope. Although trustees who are themselves companies may fall within the regime.

Benefits of a PTC Structure

Family control

PTCs provide a means by which the client, or their family, can retain a greater degree of control over the trust affairs without compromising the validity of the family trusts. The client can compose the board of directors with themself, family members and trusted advisers who have a heightened knowledge of the family’s business and financial affairs and are empathetic to the needs of the beneficiaries. Careful thought needs to be given to the composition of the board of the PTC and also who is to have power to appoint and remove its directors.

Avoiding future changes in trusteeship

Having a PTC as trustee of family trusts will avoid the need for future changes of trusteeship. Instead, only the management agreement between the PTC and the licensed administrator would need to be terminated and a new agreement would need to be entered into between the PTC and the new licensed administrator, with the old licensed administrator’s PTC directors (if any) ceasing to be on the board of the PTC.

Confidential

Ownership of the structure can remain confidential when structured with the use of, for example, a purpose trust.

Trustee liability

Professional trustees are always aware of their liability and the risk of being sued, not only by beneficiaries but also third parties. As a result, professional trustees are reluctant to take ownership of assets or participate in ventures where substantial risks may be present. PTCs (due to the composition of the board) can provide for riskier investments to be included in the structure.

Philanthropy

PTCs can make confidential philanthropic payments whilst ensuring the person managing the structure understands their thought process in providing for such causes.

Flexibility

A PTC is likely to be more flexible and quicker in dealing with trust assets.

Practical Issues with a PTC Structure

As with all good things there are potential pitfalls relating to PTC structures which include the following:

Central management and control

As the residency of a trust normally depends upon where the trust is administered and where the majority of trustees are resident, it is important the PTC is not resident in an unfavourable jurisdiction where it could be argued it is managed and controlled and as a consequence the trusts are resident (with adverse tax consequences). In addition to having the majority of the directors in the jurisdiction where the PTC has its registered office, the directors must be seen to be properly discharging their duties, understanding what they are doing, meeting to discuss and being aware of the company’s business.

The sham argument

To avoid the possibility that the structure is attacked as a sham, there must be evidence that the settlor/client and the trustee (the PTC) intended to set up a proper trust structure which should be run as such. The use of a licensed administrator to carry out the general administration of the PTC and underlying trusts should help avoid such sham attack.

Liability of directors

Directors of PTC’s, like any other directors, have a duty to act in the best interests of the company and where they breach this duty, the general rule is that the duties imposed upon them are owed to the company and not the shareholders – thus the company would have to action the directors. That said, there is the possibility, although remote where no fraud or sham, that the shareholders could action the directors by way of a “dog leg claim”.

PTC structures are bespoke vehicles which can provide many benefits, although they are not for everyone. Careful consideration should be given at the outset and professional advice sought.

PTCs can be set up and administered (according to local legislation and regulation) in a number of jurisdictions including the majority of offshore jurisdictions in which Appleby operates.

What is a private trust company (PTC)?

A private trust company (PTC) is a privately owned company incorporated specifically to act as trustee of one or more family trusts. Like any other company, a PTC is run by its board of directors, who in the case of a PTC make the trustee decisions. Whilst run by the board of directors, PTCs are usually administered by a professional trustee who is experienced at carrying out trust and corporate administration. PTCs can be set up and administered (according to local legislation and regulation) in a number of offshore jurisdictions.

Guernsey as a jurisdiction

As a British Crown Dependency, Guernsey has a stable and reliable legal system. With a long history of political stability, a highly respected regulatory framework and its accessibility via an established infrastructure make it a desirable international offshore destination for businesses. Guernsey’s agile and pro-business government, low tax regime and compliance with international standards of regulation and transparency provide a secure and competitive choice for trusts and trust related structures.

This guide was last updated in January 2023. It is routinely reviewed by Appleby and updated when changes to the law require it. This guide is for general guidance only and does not constitute definitive advice. Please contact one of our lawyers if you require more detailed information.