Taking a Jersey company private: Is there a new kid on the block?

2021 was a record year for global M&A activity with Reuters reporting that global M&A volumes topped USD5 trillion for the first time ever, comfortably eclipsing the previous record of USD4.55 trillion set in 2007. Within this flurry of deal making there was a remarkable increase on the number of ‘public to private’ or ‘take private’ transactions driven by a combination of highly capitalised private equity funds and a sluggish recovery in certain equities to pre-pandemic levels. It is no surprise therefore that Jersey, as a leading international finance centre, enjoyed a record-breaking year in deal activity including a number of take private transactions. Take private transactions in Jersey have frequently been implemented by members’ schemes of arrangement under Part 18A of Companies (Jersey) Law 1991 (CJL). This article focuses on the emergence of a statutory merger under Part 18B of CJL as an alternative method of implementing a take-private of a Jersey company following the recent take private of Atrium European Real Estate (AERE) by Gazit-Globe Limited (on which Appleby advised AERE (see Appleby advise Atrium European Real Estate Limited on its ground breaking €1.45 billion merger with Gazit Globe Limited)

Jersey Market overview

The public M&A market continued to be very hot in 2021 and shows no sign of slowing down in the first part of 2022 with recommended offers announced during this period for the likes of ADVANZ PHARMA, Sanne Group, Mimecast and AERE. All of the aforementioned offers, save for AERE, have been implemented or are proposed to be implemented by a members’ scheme of arrangement under Part 18A of CJL. The take private of AERE which completed on 18 February 2022 was implemented by a statutory merger under Part 18B of CJL which marks an interesting departure from the traditional route of a members’ scheme of arrangement. Formal takeover offers utilizing squeeze out provisions under Part 18 of CJL remain almost unheard of in the Jersey market and are likely to only be considered in a hostile takeover scenario and accordingly this article explores the possibility of the statutory merger as an alternative method to a members’ scheme of arrangement only.

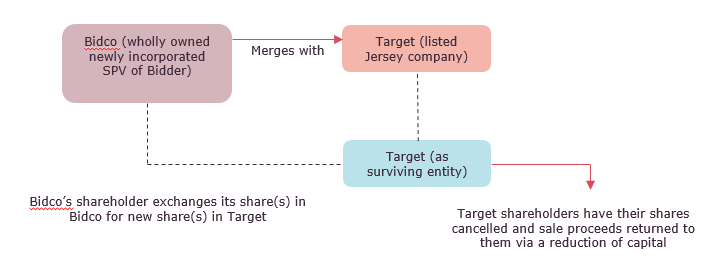

Statutory merger for a take private: how does this work?

There are a number of alternative permutations to the structure outlined above e.g. the surviving entity could be the Bidco or a new third-party entity or the merger could be implemented by the bidder listed entity being the surviving entity. The legislation is quite flexible in this regard.

The key high-level steps to implementing a take private by a statutory merger are:

- Approval of target board and bidder board of merger agreement.

- Extraordinary general meeting of target and bidder convened to consider and approve merger agreement. For the merger to proceed the merger agreement requires the approval by special resolution of each class of members of the target and the bidder (if the bidder is a Jersey entity). As part of convening the extraordinary general meeting a shareholder circular is sent to target shareholders (and if necessary bidder shareholders) setting out the key terms of the merger.

- Assuming shareholder approval is forthcoming there is then a 21-day objection period for dissenting shareholders and creditors to file an objection with the Royal Court of Jersey on the grounds that the proposed merger unfairly prejudices their interests. The law and jurisprudence on unfair prejudice in Jersey is very closely aligned with the position under English law.

- On the basis that either no shareholder or creditor objections are received or such objections are disposed of then the target and bidder apply to registrar of companies in Jersey to register the merger at which point the merger completes.

From a practical perspective, the following points should be noted:

- It would be open to a bidder that holds shares in the target to vote on the special resolution to approve the merger therefore potentially significantly lowering the threshold required to approve the transaction.

- The directors of both the target and the bidder are required to provide certain certifications as part of the process e.g. certifications as to the solvency on a cash flow basis of the target / bidder (as applicable) for the period commencing on the date of formal board approval of the merger until completion of the merger.

The merger cannot be registered (and therefore the transaction cannot complete) if there are any subsisting shareholder or creditor objections.

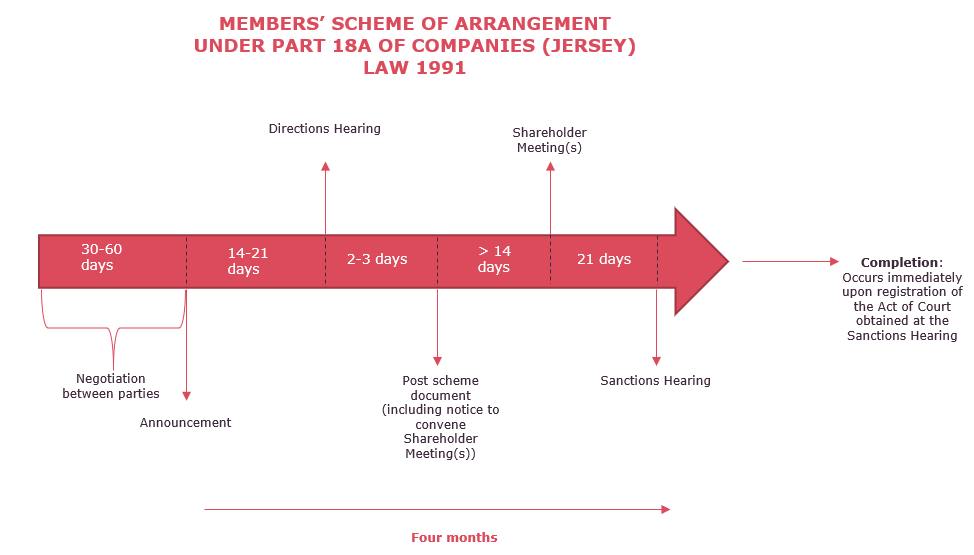

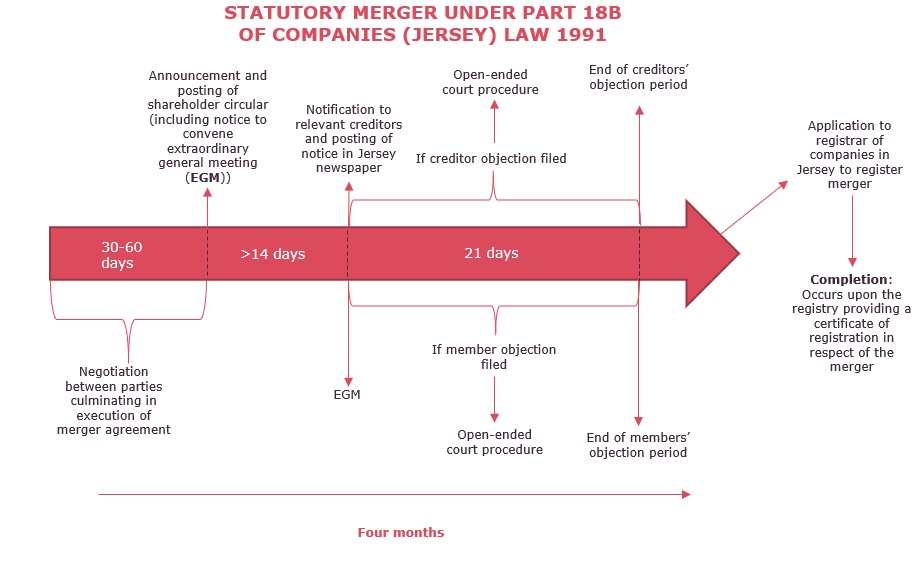

Timeline: Statutory merger v members’ scheme of arrangement

In our experience each transaction will have its own unique timing considerations which will need to be considered prior to deciding which route to implement the transaction. High-level timelines of a take private of a Jersey company for both a statutory merger and a members’ scheme of arrangement are set out below.

Statutory merger v members’ scheme of arrangement: key pros & cons

In addition to timing considerations there will be a number of other commercial factors at play that advisors will need to consider. The key pros and cons of each route to implement the transaction are set out below.

| STATUTORY MERGER | SCHEME OF ARRANGEMENT | |

| PROS |

|

|

| CONS |

|

|

Statutory mergers as means to implement a take private of a Jersey company: a flash in the pan or here to stay?

A key factor in whether a statutory merger will evolve as a mainstream method of taking Jersey companies private will be how the takeover regulators in the relevant jurisdictions on which the Jersey company is listed respond to the proposal to implement the take private by a statutory merger. Given the London Stock Exchange is by far the most popular destination for Jersey listed companies the views of the UK Takeover Panel will therefore be key in this regard. Our soundings on this point have been encouraging with our understanding being that the UK Takeover Panel would not stand in the way of a process clearly contemplated under Jersey law. It may be that small tweaks around the edges are required to the UK Takeover Panel’s processes though nothing that cannot be managed as part of any transaction.

In other jurisdictions such as the Cayman Islands the statutory merger has already evolved to be the most commonly used method to implement a take private transaction. It is worth noting the regimes in Jersey and the Cayman Islands are similar but not entirely comparable. Further, Cayman Islands companies are not subject to the UK Takeover Code which is no doubt relevant to the prominence of the statutory merger as a method to implement a take private transaction.

We expect that once clients become aware of the merger alternative (in the context of a take private transaction) momentum will start to grow for this method particularly given the lower approval thresholds required. However, the appeal of the tried and tested method of a members’ scheme of arrangement is not to be underestimated. In practice we expect that the commercial factors unique to each proposed take private (such as shareholder base of the Jersey target, jurisdiction of listing and post-closing structuring requirements) will mean one method will be more desirable than the other. Watch this space.