WHAT ARE PTCS?

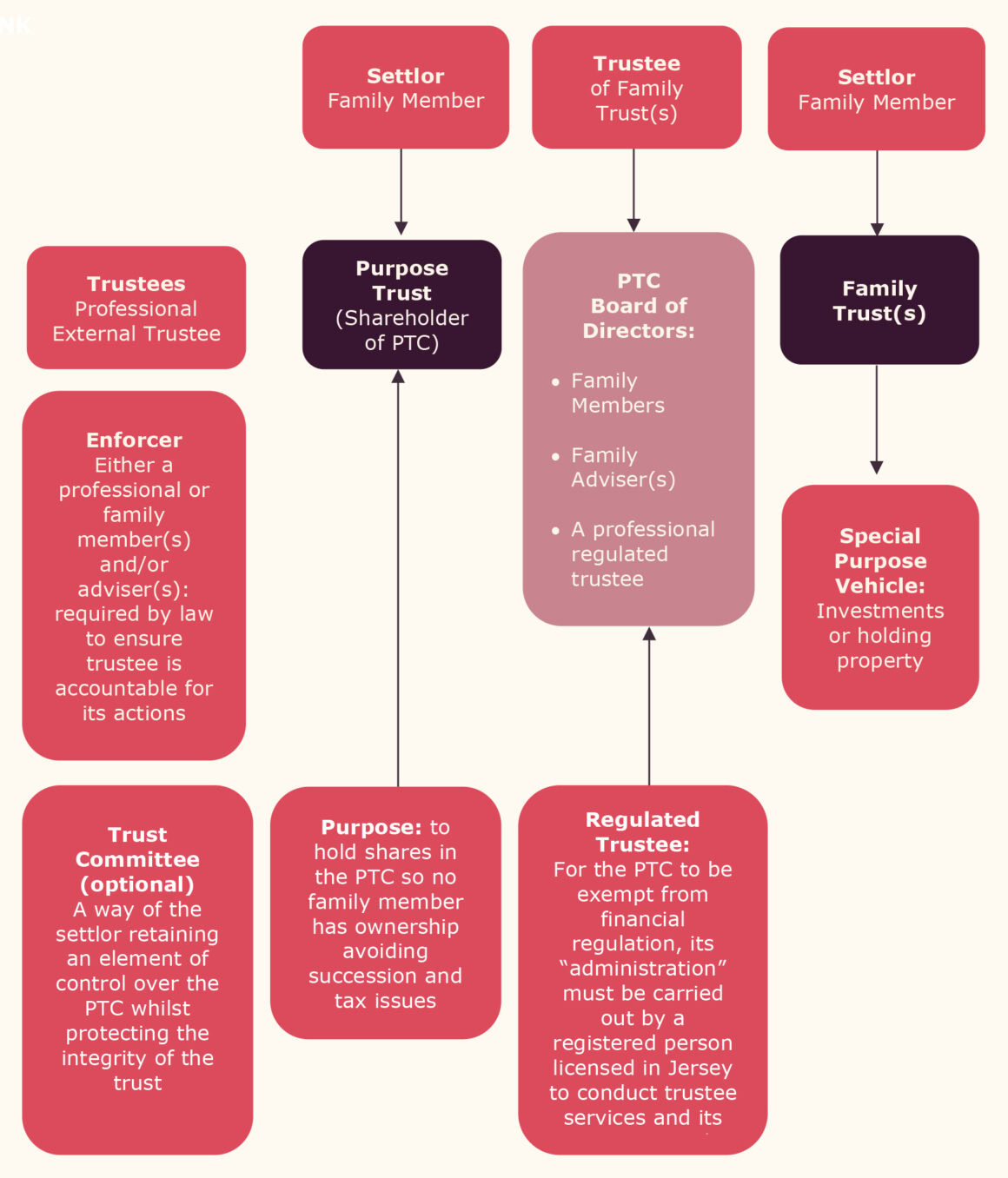

PTCs (more fully referred to as Private Trust Companies) are what their name depicts, privately owned companies that act as trustee of one or more family trusts. The PTC structure (see typical example below) has seen increasing popularity amongst UHNWIs wanting to have their own trust company act as trustee of the family trusts, albeit with the assistance of a professional trustee.

Like any other company, a PTC is run by its board of directors, who in the case of a PTC make the trustee decisions. Whilst run by the board of directors, PTCs (and the underlying trust for which it acts as trustee) are usually administered by a professional trustee with experience in trust and company administration.

WHAT DOES A TYPICAL PTC STRUCTURE LOOK LIKE?

The following is what could be described as a typical PTC structure. PTC structures are very flexible and can be modified in a variety of ways to accommodate the particular needs of a client.

OWNERSHIP OF THE PTC

Whilst the client could own the shares in the PTC directly, it would probably be undesirable for them to have any direct link with the PTC’s ownership; whether for tax, disclosure or for a variety of other reasons. Therefore other vehicles such as a purpose trust or a foundation are considered more appropriate, the advantage being that the shares in the PTC are not directly attached to the client. The above structure refers to a “purpose trust” holding the shares in the company (PTC) which will act as trustee of the family trust(s). A purpose trust is a particular type of trust which, unlike a conventional trust, can be formed to hold assets for a purpose without conferring a benefit on any person. Here the purpose would be to hold the shares in the PTC.

ESTABLISHMENT, BOARD, LICENSING & ADMINISTRATION OF PTC

Establishment: The incorporation of a Jersey PTC is the same as for any other Jersey company with an application being made to the Jersey Companies Registry by an authorised corporate service provider and incorporation taking as little as two hours.

Board: The PTC will be run by its board of directors and therefore careful thought needs to be given to the choice of directors to ensure that the PTC and ultimately the underlying trusts are run properly whilst avoiding potential pitfalls regarding management and control.

Licensing and Administration: The Financial Services (Trust Company Business (Exemptions)) (Jersey) Order 2000 contains an exemption from the licensing of a PTC as a trustee of a trust. To qualify for the exemption, the purpose of the PTC must be solely to provide trustee services in respect of a specific trust or trusts and must not solicit from or provide trustee services to the public. In other words, the trust or trusts must relate to the same family or group of persons. In addition, it is a requirement of the exemption that the “administration” of the PTC is carried out by a registered person who is licensed to carry out trust company business by the Jersey Financial Services Commission. It is unclear what is meant by “administration”. Consequently, Jersey regulated and licensed service providers will insist that they be a director of the PTC, with a requirement they be involved in every decision of the board. This is to ensure they are involved in the “administration”. However, often families will not wish a service provider to be a director of the PTC. In such cases, it may be acceptable for the regulated and licensed service provider to be company secretary to the PTC in order to fulfil the “administration” requirement. However, it is difficult to know if the role of company secretary is sufficient to fulfil the “administration” requirement. Therefore, best practice is for a service provider to be a director of the PTC.

Name: It is not a requirement that the name of the PTC includes “PTC”. However, it is often the case that many do include “PTC”.

THE BENEFITS OF A PTC STRUCTURE

Family control: PTCs provide a means by which the settlor, or their family, can retain a greater degree of control over the trust affairs without compromising the validity of the family trusts. The board of directors can comprise the settlor, family members and trusted advisers who have heighted knowledge

Avoiding future changes in trusteeship: Having a PTC as trustee of family trusts will avoid the need for future changes of trusteeship. The PTC remains in office as trustee. Therefore, instead, the directors of the PTC may be changed in accordance with the articles of association of the PTC. If professional officers (including the regulated and licensed service provider to the PTC) are resigning or being removed from the board, then the PTC will need to terminate any existing, and enter into a new, service agreement.

Confidentiality: Ownership of the structure can remain confidential when structured with the use of, for example, a purpose trust.

Trustee Liability: Professional trustees are always aware of their liability and the risk of being sued, not only by beneficiaries but also third parties. As a result, professional trustees are reluctant to own assets or participate in ventures where substantial risks may be present. PTCs (due to the composition of the board) can provide for riskier investments to be included in the structure.

Philanthropy: PTCs can make confidential philanthropic payments whilst ensuring the person managing the structure understands their thought process in providing for such causes.

Flexibility: A PTC Is likely to be more flexible and quicker in dealing with trust assets.

PRACTICAL ISSUES WITH A PTC STRUCTURE

As with all good things, there are potential pitfalls relating to PTC structures which include the following:

Central Management and Control: The tax residency of the trust normally depends upon where the trust is administered and where the majority of directors are resident. It is important that it cannot be argued that the PTC is managed and controlled, and therefore resident, in an unfavourable jurisdiction. This will result in adverse tax consequences for the PTC. Consequently, it is important that the majority of directors are resident in, or participate in board meetings from, a jurisdiction where no adverse tax consequences will occur. Additionally, the directors of the PTC must be seen to be properly discharging their fiduciary duties, understanding what they are doing, meeting to discuss and be aware of the company’s business.

The Sham Argument: To avoid the possibility that the structure is attacked as a sham, there must be evidence that the settlor and the trustee (PTC) intended to establish a proper trust structure and for it to be administered as such. The use of regulated and licensed service provider as a director to provide the “administration” requirement is of assistance in this regard. Furthermore, the settlor should ensure that any protector or enforcer role is not too controlling and any powers are fiduciary in nature; both of which will assist to argue against a sham argument.

Liability of Directors: Directors of PTCs, like any other directors, have a duty to act in the best interests of the company and where they breach this duty, the general rule is that the duties imposed upon them are owed to the company and not the shareholders. Therefore, the company would have to action the directors. That said, there is the possibility, although remote where there is no fraud or sham, that the shareholders could action the directors by way of a “dog leg claim”.

CONCLUSION

PTC structures are bespoke vehicles which can provide many benefits, although they are not for every family. Therefore, careful consideration should be taken at the outset and professional advice sought. PTC structures can be established and administered (accordingly to local legislation and regulation) in a number of jurisdictions including the majority of offshore jurisdictions in which Appleby operates.

For more specific advice on trusts in Jersey, we invite you to contact Giles Corbin or Nichola Aldridge