First published in Connect Guernsey December 2018

In September HMRC published revisions to its inheritance tax (IHT) manuals relating to its interpretation of where a specialty debt (a specialty) is sited. There has been little commentary on the revisions, even though they provide certainty for some.

But first, what is a specialty? And second, why might it be of interest to someone who is not domiciled (actual or deemed) in the UK (a non-domiciliary)?

A specialty is more usually a debt created under a deed, which is what I shall focus on.

As a general rule, assets located in the UK are subject to UK IHT regardless of the domicile of the owner. Non-UK situs assets are ‘excluded property’ for UK IHT purposes if owned by a non-domiciliary. Foreign situs assets settled on trust by a non-domiciliary can be permanently excluded from IHT.

Where a debt is sited normally follows the debtor’s residence. However, the situs of a specialty which is enforceable by action historically has been determined by reference to the physical location of the deed and not the debtor’s residence. This meant that keeping the deed outside the UK resulted in such debt being foreign property.

This is especially useful in relation to a debt owed to an individual who is a non-domiciliary. Such debt would be UK sited if the debtor is UK resident unless it is a speciality and thus free of IHT unless the creditor becomes UK domiciled.

A specialty settled by a non-domiciliary on trust would be excluded property and as such not be subject to transfer and periodic charges, potentially permanently.

Furthermore, offshore trustees could lend money to UK resident beneficiaries without being deemed to be holding UK assets with UK tax payment and reporting requirements.

Accordingly, a specialty constituted a commonly used, effective method of mitigating IHT exposure for non-domiciliaries and trustees.

In 2013 HMRC updated its manuals, stating it believed “that…debts are situated where the debtor resides”, thus changing a specialty to a simple contract debt for tax purposes.

Trustees with loans to UK resident beneficiaries would be deemed to be holding UK assets and be subject to UK tax payment and reporting requirements. Non-domiciliaries owed money by UK residents would likewise be deemed to be holding UK assets.

Despite requests for clarification from professional bodies, in 2014 HMRC stated that all debts “are likely to be located” where the debtor is resident and that it would refer all cases involving specialties to its technical team. This left much uncertainty.

HMRC has now given some clarification, although it is questionable whether its revisions are entirely correct.

HMRC will generally adopt the following approach:

Where the debt is secured on land or other tangible property situated in the UK, the situs of the debt will also be in the UK. The situs of the debt will follow the interest of the creditor in the secured property and not the personal obligation of the debtor to repay.

Where the debt is unsecured, the situs of the debt is usually where the deed evidencing the debt is found. However, where both debtor and creditor are UK resident, HMRC may argue that the debt is UK property.

Planning for IHT using specialties remains an option but should be approached with caution and bearing in mind the UK general anti-avoidance rule. Trustees should have examined such debts under the requirement to correct provisions.

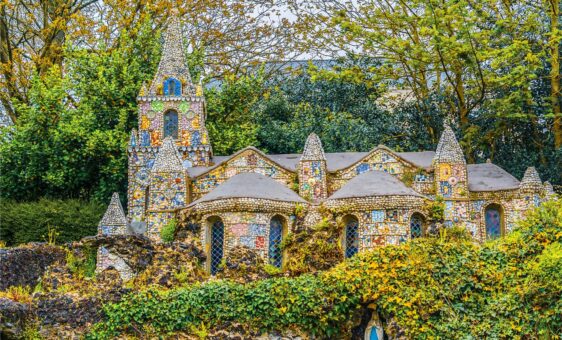

As for the Channel Islands, there is no concept of a deed under Guernsey or Jersey law. However, a deed governed under a law other than that of Guernsey or Jersey may be expressed to be enforceable only in Guernsey or Jersey (as the case may be) and physically held in the jurisdiction so as to be a specialty.